This article reviews the topic of gamification in banking. Read further to get vital information.

Many modern publications promote the concept of gamification in banking. If you’re reading this article, you’re likely searching for a comprehensive review on the topic. We’ll look at the definition of gamification in business, its benefits, challenges, and some examples of real-life applications. With this knowledge, you’ll finally have sufficient insight into the topic of gamification. It should be enough to help in decision-making.

What is Gamification in the Business Environment?

Let’s first define the key terms that have to do with gamification in banking. It’s time to learn about the main benefits of this innovation:

Definition of gamification

The idea of gamification is simple: it’s about making boring processes interesting. Let’s consider two fields, video games and finance. Our culture perceives the former as interesting and the latter as boring. We associate banks with something difficult (labor) and often dangerous (in the case of loans). Gamification in banking helps solve this problem by adding elements from video games into finance. What does this mean in practice? Here’s an example of an achievement system from Steam, the largest gaming platform on PC. It awards some points to users for certain actions in games. Using them, one can later purchase decorations for their account (or other bonuses). A robust internal economy now exists for these items. Gamification in ‘boring’ fields works similarly. It awards users for actions like spending money in a restaurant. Bonus points from these actions later go towards some company-specific decorations or services. This principle ultimately works in many fields: you can utilize it in education, marketing, healthcare, and finance.

How gamification helps your business

What are the benefits of gamification in banking or any other field? Here are some of them:

1) It makes boring or complex processes interesting: many fields, such as education or healthcare, are commonly seen as boring or complicated. This means the average users quickly lose attention to them unless they’re enthusiasts. Gamification, as we’ve mentioned before, solves this problem. It gives some additional rewards capable of making the whole process more enticing. Many people like collecting prizes, for example, and gamification helps with this.

2) It pushes the users toward rational actions: let’s consider the financial field as an example. We know from the current statistics that Millennials are bad at saving funds. This is an irrational strategy in the long-term scenario that will lead many people toward poverty later in their lives. Many Millennials are quite aware of their bad habits. What they lack is an incentive. Gamification in banking apps offers such an incentive. It provides bonuses for positive financial actions, such as saving funds or paying off loans. These games won’t help everyone, but they can push some Millennials, for instance, toward better financial discipline.

3) It improves brand image: we perceive banks as rather mundane businesses that don’t have major differences from each other. Gamification creates an image of a user-friendly facility. Some companies, such as BBVA, manage to build a significant portion of their brand image around gamification.

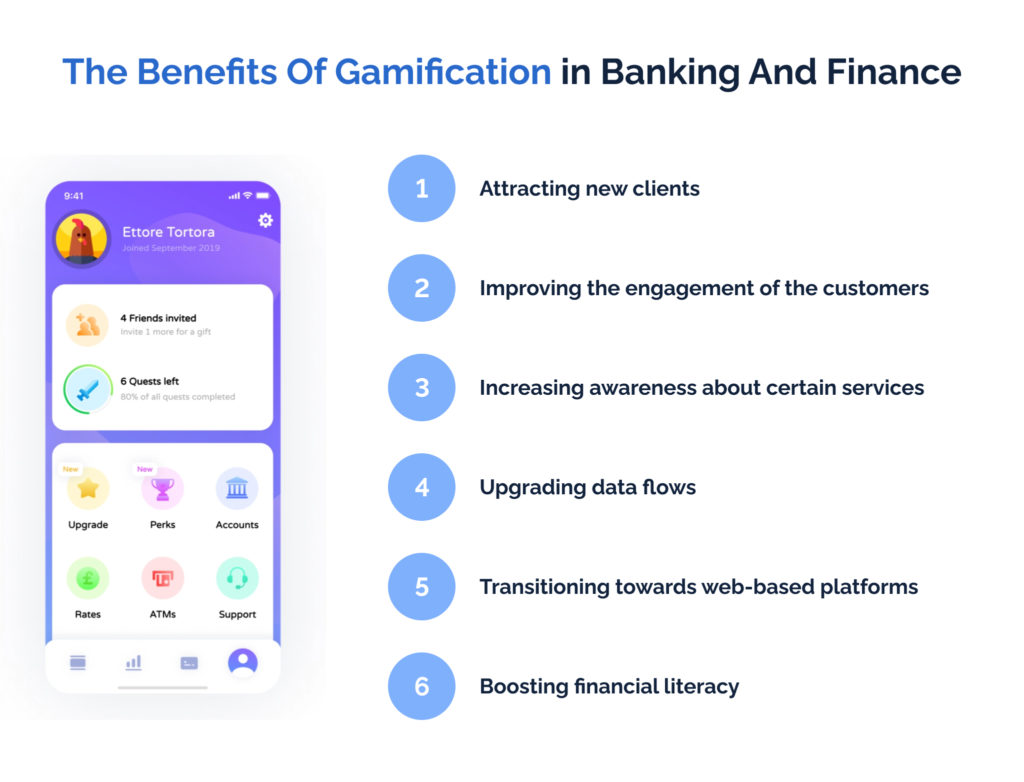

The Benefits Of Gamification in Banking And Finance

Gamification in banking is a topical business idea. Many users want some interesting features in their everyday experiences. Let’s look at the specific benefits you can get:

Attracting new clients

Gamification often implies some interesting bonuses for the users. You get new services from the bank or even receive physical rewards, such as clothing or some collectible figures. This feature is likely to attract new clients. For people who like using their credit cards often, these bonuses are a perfect addition to their spending patterns. Finance gamification attracts users by offering them some goods or ways to compete.

Improving the engagement of the customers

After spending tremendous funds on a financial app, developers often discover that the clients use only a minimum of functions. To prevent such a situation, the best option is to use gamification. This process pushes the users to find other aspects of your app interesting. For example, financial management or credit history may be of greater interest to the users if you add game elements to them. This approach will push the average customers towards a higher level of engagement through financial gamification.

Increasing awareness about certain services

Many customers don’t even know about certain offerings of their banks. Gamification in finance solves this problem. It helps highlight some opportunities the customers wouldn’t have used in other circumstances. For instance, a point system can push people towards using cashback.

Upgrading data flows

We live in an era of so-called Big Data. Market leaders win by ‘mining’ unique information regarding the users’ behavioral patterns. Gamification in banking is a perfect opportunity to boost the overall data flow. By engaging the users and attracting new individuals, this framework increases insights into behavioral patterns and gives more opportunities for analyzing the relevant information.

Transitioning towards web-based platforms

Many banks rely on traditional frameworks, such as paper records. Gamification in finance is a perfect opportunity to break the mold and start major reforms. When a company decides to gamify its platforms, it has no choice but to invest in online-centric frameworks. Gamification is a perfect boost for reforms.

Boosting financial literacy

Many people want to learn how to manage funds but don’t know where to find high-quality materials. Gamification of finance is a solution to this problem. Through game elements, it’s possible to show the users which actions are positive for them and society. For instance, one can offer bonuses for saving funds. Even a rather random decision to put off some funds to get bonuses may eventually push many individuals toward considering long-term savings. They’ll get a financial safety net in this way, which will push them towards rationality.

Related services

BANKING AND FINANCIAL SOFTWARE DEVELOPMENT SERVICES

Types of Gamification Used in Digital Banking

Multiple types of gamification in finance and banking appear. Different types have their diverging benefits. Here are some of them:

Reward and loyalty systems

Systems of this type incentivize the users by giving them various rewards for certain positive actions. For instance, the customers get points they can later spend in an internal store, cashback, or even full-scale discounts in certain locations. The key benefit of these systems is their directness: they give tangible things for rational financial activities.

Financial education games

This software aims to teach the users through game-like elements such as quizzes or challenges. It doesn’t involve any real finance but instead simulates different situations. A good old-school example of a financial education game is Monopoly, which teaches the players about the basics of the economy.

Goal-oriented apps.

Some apps allow users to set particular goals and then offer game-like tracking. They provide various progress bars and even achievement systems to assist the users. Monobank, which we’ll discuss below, helps track spending and savings through high-quality visuals. The key benefit is visualization, which allows the processing of financial decisions in a better way than numbers.

Implementation of Gamification in Finance and Banking

Gamification in banking involves multiple approaches mentioned above. Banks add reward systems, promote education quizzes, or offer goal-oriented frameworks. The best results appear when a combination of these methods is used, but they work well alone too. Gamification in banking provides a large number of opportunities for the average developer. One should not be afraid to experiment: the users may crave different approaches.

Gamification In Banking And Finance Examples

BBVA

BBVA is notable for winning several awards for its gamification in banking efforts. The key innovation, in this case, is the so-called “BBVA Game.” This game teaches users how to manage funds, save money, and make informed financial decisions. The users win points in a virtual economy by making high-quality economic choices. They can later be spent on music downloads, films, and tickets.

Bank of America

Bank of America, one of the most popular financial facilities in the U.S., also actively uses gamification. It teaches financial literacy to the customers via these frameworks. The program is called ‘Better Money Habits.’ It includes various monitoring tools for finance, quizzes, and games capable of instructing users about proper financial management.

Monobank

Monobank is one of the most innovative banks in Eastern Europe. Situated in Ukraine, it has turned the whole user experience into a game. What does Monobank do? It has an achievement system similar to video games such as World of Warcraft. For some specific actions, the users get a reward in the form of an ‘achievement,’ a virtual prize with unique visuals. If you go to restaurants often, the app will give you a particular achievement. Do you like electronic devices? Monobank will give you new awards. Achievements carry some point rewards. One can later exchange them for some physical prizes such as hoodies. This system entices the users, pushing them to try out new experiences through novel purchases.

Capital One

Capital One also offers a valuable gamification app. The company has a financial management solution named “CreditWise,” which features a so-called “Credit Simulator.” Using it, the users can see how their credit score would react to different activities. Predicting the outcomes of paying off debt or opening a new credit card is possible. This feature is both entertaining and informative. You may use it for serious planning or to analyze how the credit system works.

Standard Chartered Bank

Standard Chartered Bank also offers its users a set of interesting solutions. Its Breeze app combines traditional financial management with gamification in banking. The users get rewards for every action (i.e., paying bills). One can later spend these points on some internal bonuses within the system. This framework enables users to treat their financial obligations seriously.

Challenges of Gamification in Banking

Gamification in finance has some challenges. Firstly, one needs to maximize security. A reward system may easily become another weak point in the safety framework of a bank. The more code you have, the higher the probability of bugs. Secondly, it’s crucial to comply with regulations regarding banking. Some forms of gamification, such as loot boxes, can have a significant destructive potential for the average user. It’s essential to ensure users don’t overspend by taking out too many loans, for example, to get some awards.

Potential of Gamification

Gamification of finance is a field with a great future. Today, it can boost the users’ financial knowledge and improve engagement for the banks. As for the future, the capabilities are even greater. As more elements of video games enter the field, developers have a greater number of opportunities. We may expect social/collaborative game-centric financial apps, integration of AI in banking, and a higher level of personalization. Virtual and Augmented Reality can also appear in various projects teaching about finance or visualizing the fund-related status of an individual.

How Can KeenEthics Help?

KeenEthics can assist with gamification for various banks because the company has relevant experience. Firstly, our developers know how to work with the key development platforms for the web (i.e., JavaScript and Node.js). Secondly, we have experience developing projects that include gamification in banking examples. Tetrami, which allows users to challenge each other and win discounts, perfectly represents a financial app with gamification elements. Other interesting projects of this kind include Pace Revenue and BankerAdvisor. Don’t hesitate to address us! We know how to develop an interesting gamification in finance solutions.

Conclusion

To summarize, the presented information highlights the importance of gamification in banking. Many projects become popular because of the game-like elements in them. If you want to succeed in the modern highly competitive world, investing in innovations is crucial. Are you interested? In that case, the most rational solution is to think about cooperation with some development firms.

Common Questions About Gamification in Banking and Finance

What is gamification in finance?

What are the key reasons to use gamification in banking?

Gamification in banking makes sense because it educates the users and boosts their engagement.

What helps attract customers via gamification?

Good lessons about finance (the ability to learn) and interesting reward systems for the average users.

Is gamification necessary?

More and more businesses in finance are using it. Most likely, it’ll become an essential requirement for all banking apps.

Our firm can help. Contact us, and we’ll offer you high-quality solutions.

Search

Search